Equity Markets, Political Situations, and Possible Strategies

Tension between the West and Russia over Ukraine remain intact. Unfortunately, we did not anticipate a political escalation in Ukraine and its negative influence on European equities markets. Comparing the US and European equity markets, the US performed slightly better.

We have been monitoring the situation with Ukraine closely over the last couple of weeks. Our view is that Russia does not want to get openly involved in Eastern/Southern Ukraine, as it may lead to a much more serious situation. Some groups in Ukraine are trying to provoke Russia to intervene, which has not succeeded yet. Western media sentiment over Ukraine has seemed to change slightly. The European media in particular has started to report more critically on Ukraine and its current government. After the referendum in Donetsk and Lugansk region, the Ukrainian government declared that it is willing to talk to separatist leaders. This is a good sign and we would recommend buying Russia equities, especially in the energy sector. Russian equities are comparably cheap, with the Market Vectors Russia ETF showing a Price-to-Earnings ratio of 5.44 and Price-to-Book of 0.7 compared to an average P/E of around 10 for Emerging Markets and around 15 for MSCI World, respectively.

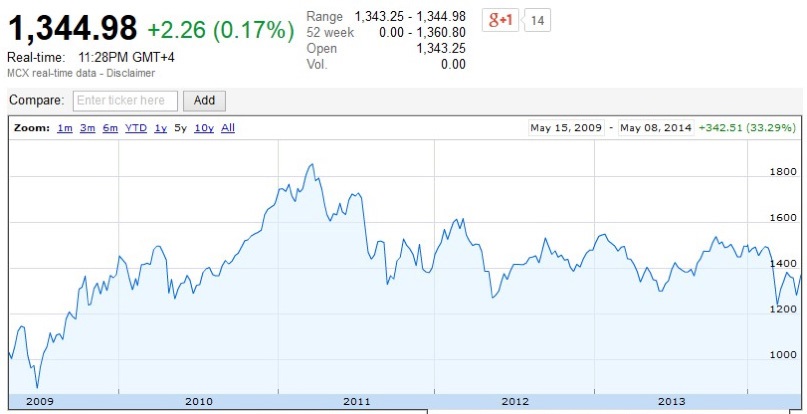

Micex 5-Year Development 1

Micex 5-Year Development 1

The political situation can still undermine our recommendations. As said before, we see the situation getting better now but one should not forget that different interest groups are active in Ukraine, with some looking for confrontation. We will continue to monitor the developments closely.

Besides the political troubles, we see huge recovery potential in the Russian equity markets. It might not recover in the short-term but within the next year or two the market has the potential to double. This is highlighted by cheap valuations. Especially companies like Gazprom, Surgutneftegaz or Lukoil.

The political crisis is accompanied by increased market volatility. When the political situation eventually stabilizes, we do not expect tighter economic sanctions over Russia. Shoreline’s opinion is that politicians and businesses will do everything to calm the situation down.

Our clients have been increasingly asking us how they could profit from the current uncertainties in the markets, especially focusing on companies doing business in Russia. Our simplest answer is to invest in select Russian equities and Russian corporate Eurobonds. Eurobonds of government-backed companies like Sberbank, Gazprom and Rosneft are our favorites. For investors that are more comfortable with short term volatility we recommend direct equity investments. With Russian equities, we prefer select companies that do not have direct government involvement such as Lukoil, MTS and PhosAgro.

Current developments in China regarding an emergence of corporations missing debt repayments are worrisome. China experts have been warning about the massive “shadow banking system” for years. This refers to non-bank financial institutions which use various mechanisms to circumvent the rigid government restrictions on interest rates and lending rates. The concern is that there may be a “Lehman Brothers” event where a massive default or bankruptcy causes wide-spread financial panic. Chinese authorities declared that they are not willing to bailout distressed companies anymore, which could worsen the situation. Shoreline views the situation as being fragile, but not urgent (yet). This is because the Chinese government has enormous reserve funds to extinguish any fires which may start. However, we would avoid Chinese equities and recommend staying overweight on developed markets, especially Europe. Major risks remain and investors should be aware of the fact that markets are volatile. Many developed markets are close to its highs and a correction will happen eventually. To determine this point in time, analyzing market conditions and active management of the portfolio is vital.

The European Central Bank (ECB) is likely to start non-conventional measures next month, such as buying bonds or asset backed securities. The ECB will attempt to weaken the Euro as a way to support European economies and to spark inflation. This strongly supports our previous suggestions to buy select European equities as ECB measures are highly likely to benefit this asset class.

Overall recommendations:

Buys: Europe, Brazil, India, Russia

Neutral: US, ASEAN

Sell: Japan, China

Although we recommend selling Chinese equities in general at this point, Shoreline is recommending some particular Chinese/Hong Kong equities with low correlation to the shadow banking system.

DISCLAIMER: Comments/charts do not necessarily imply their suitability for individual portfolios or situations in respect of which further advice should be sought. Shoreline is not responsible for the content of external internet sites. This information used in this newsletter has been prepared from a wide variety of sources that Shoreline,to the best of its knowledge and belief, considers accurate. You should make your own enquiries about the investments and we strongly suggest you seek advice before acting upon any recommendation. The opinions expressed in this report are those held by the authors at the time of going to print. The views expressed herein are not to be taken as advice or recommendation to sell or buy shares. This material should not be relied on as including sufficient information to support an investment decision. Any forecasts or opinions expressed are Shoreline’s own at the date of this document and may be subject to change.

WARNING: Investing involves risk. The information provided by Shoreline in this newsletter is for general information only, which means it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it, seeking advice from a financial adviser or stockbroker if necessary.