Investment risk tolerance – know your profile for better investing

Every investor has a profile for risk tolerance, either by instinct or ‘officially’ determined by an investment adviser.

What is risk profiling:

Risk profiling is the process of evaluating a person’s attitude to risk. A risk profile identifies:

1. The acceptable level of risk an individual is prepared to accept.

2. The risks and requirements an individual already faces. The risk profile should include unique circumstances, legal and regulatory factors, tax concerns, time horizon and liquidity needs.

When preparing a risk profile one has to distinguish between willingness and ability to take risk. Both determine the level of acceptable risk, however the ability to bear risk differs significantly from the willingness to take risk.

A person’s ability to take risk is mostly determined by external factors such as time constraints, career stability and current wealth. In other words, the risk an investor financially can afford.

A person’s willingness to take risk is mostly determined by internal factors such as personality and behavioral tendencies.

The combination of an investor’s willingness and ability to take risk will determine their risk tolerance.

Either willingness or ability to take risk can take priority when determining an investor’s risk tolerance. For example, an investor who is willing to take more risk (willingness), but close to retirement (ability) will have a reduced risk tolerance. Another investor could have a long time horizon (ability), but does not want to accept negative investment results (willingness). As a result he has a reduced risk tolerance as well.

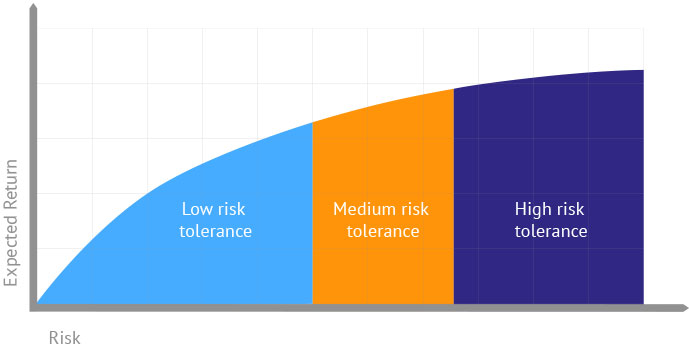

An investor risk tolerance profile is the starting point for deciding on an investment strategy. With the risk attitude established the investment strategy will fall into one of three different risk categories:

1. Risk-averse investors do not like uncertainty and volatility. Such investors are willing to settle for a lower return on their investments. Select a cautious approach.

2. Risk-neutral investors are indifferent to risk. Additional risk and volatility should be accompanied with a extra return. Select a balanced approach.

3. Risk-loving investors are willing to take more risks while investing in order to earn higher returns. Select a growth approach.

There are many factors which determine risk tolerance and an investor’s risk tolerance changes over time. It is important to regularly review investments to ensure they are still within scope of the investor’s risk tolerance. Therefore it is a good idea to regularly review an investor’s risk tolerance and adapt the investment strategy in case it has changed.

Shoreline is able to help clients determine their risk tolerance and advise on fitting investments. Regular reviews and meetings ensures the investment strategy continues to match the client’s risk attitude. Please contact us if you would like to discuss risk profiling with an advisor.