US Fed Tapering and Emerging Market Currencies

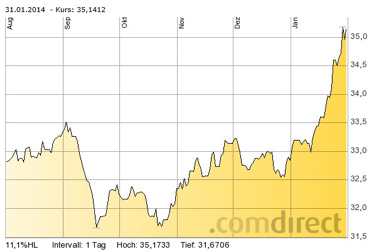

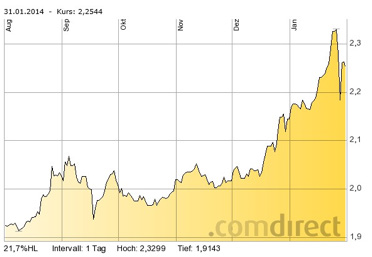

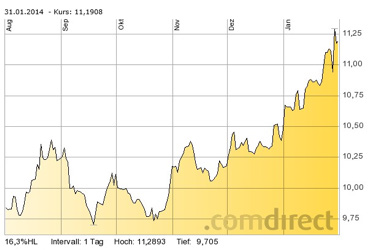

Challenging market conditions demand emerging market central banks to use unconventional methods. In an overnight action, the central bank of Turkey and South Africa raised their interest rates. In the case of Turkey, it dramatically raised its overnight lending rate from 7.75% to 12.5% and its weekly repo rate from 4.5% to 10%. South Africa was more modest with raising its rate from 5% to 5.5%. Emerging markets saw huge outflows of funds after the US Federal Reserve announced the start of the quantitative easing (QE) program tapering in 2013. This outflow, of so-called “hot money” which fueled the rapid growth of emerging countries for a long time, is now bringing emerging market currencies under pressure. Many lost 20% or more in value (see Figures 2 – 5) against the US dollar and also against other major currencies like the Euro or the British Pound. We do not see this trend reversing quickly as emerging market currencies and stock markets remain under pressure. Although emerging market equities are likely to be effected positively, we expect outperformance by equities in developed countries due to increased funds flowing back into developed markets.

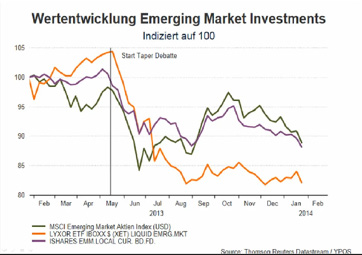

• Figure 1 shows the development of emerging markets equities and bonds. These markets have declined across the board. Although we see good potential growth in emerging markets over the long to mid-term, investors this year should prefer to invest the bigger share of fund in developed markets equities especially European equities. A more comprehensive analysis of the reasoning can be found in Shoreline’s “Markets 2013 Review – 2014 Preview” report.

• Another effect of these funds flowing back, especially into US Dollar denominated investments, are prices of US treasuries. It is hard to predict how bond prices will move in the short-term but we are convinced that over the mid and long term fundamentals we will see falling bond prices due to decreased demand from China and the Fed reducing its bond buying program.

Figure 1: Emerging Markets Development

Figure 1: Emerging Markets Development

However, the appreciation of leading currencies like the USD, EUR and GBP makes it particularly interesting for foreign investors, like Russians, to invest their money in these currencies to gain from the appreciation of the USD against the RUB. Another factor that makes it interesting to invest in dollar denominated assets and US treasuries are low inflation rates with even deflationary possibilities, especially in the Eurozone. This deflationary risk makes it attractive to invest in US Treasuries yielding around 2.75%. However, we would not recommend investing in US Bonds as in the longer term bond prices are likely to fall. Our recommendations are to invest in corporate bonds, equities and some chosen derivatives denominated in in USD, GBP or EUR offering a suitable risk-return balance. Our preferred currency for 2014 will be the USD due to Fed tapering and a positive economic outlook for the US in the upcoming year.

If you have any further questions about our current investment strategy please refer to “2013 Review – 2014 Preview report”. We explain in detail which markets we see outperforming in 2014 and how to profit from it. You can also contact us directly via office @ shorelinebrokers.com or telephone number

+7 495 956 0473.

Figure 2: Exchange Rate USD/Russian Ruble

Figure 2: Exchange Rate USD/Russian Ruble

Figure 3: Exchange Rate USD/Turkish Lira

Figure 3: Exchange Rate USD/Turkish Lira

Figure 4: Exchange Rate USD/Indonesian Rupiah

Figure 4: Exchange Rate USD/Indonesian Rupiah

Figure 5: Exchange Rate USD/South African Rand

Figure 5: Exchange Rate USD/South African Rand

DISCLAIMER: Comments/charts do not necessarily imply their suitability for individual portfolios or situations in respect of which further advice should be sought. Shoreline is not responsible for the content of external internet sites.This information used in this newsletter has been prepared from a wide variety of sources that Shoreline,to the best of its knowledge and belief, considers accurate. You should make your own enquiries about the investments and we strongly suggest you seek advice before acting upon any recommendation. The opinions expressed in this report are those held by the authors at the time of going to print. The views expressed herein are not to be taken as advice or recommendation to sell or buy shares. This material should not be relied on as including sufficient information to support an investment decision. Any forecasts or opinions expressed are Shoreline’s own at the date of this document and may be subject to change.

WARNING: Investing involves risk. The information provided by Shoreline in this newsletter is for general information only, which means it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it, seeking advice from a financial adviser or stockbroker if necessary.