Do stocks or commodities protect from inflation?

For Russian click here

In order to understand the link between inflation, the price of stocks and commodities let’s start with some theory first. Very simply said stocks are participation shares in the ownership of a company and thus share in its profits. When inflation grows companies can raise their prices which increases revenue and maintains profit per share. This increased turnover makes the company more valuable which leads to a higher stock price. This way stocks can protect an investor from inflation. In reality it is not that simple as it may not be possible to raise prices, or the increased prices lead to lower demand. However, the idea is valid.

Investors who hold 100% government and corporate bonds portfolios may think that they are invested in a safe asset, but at the moment this is not true at all. Stocks, in most cases, respond positively to increasing inflation, and bonds — negatively. Why? If inflation in US dollars is rising the US Federal Reserve, at some point, will raise the interest rates (to reduce the growth of inflation), and such increase virtually guarantees a fall in bond prices. This is logical as why would an investor hold a bond that pays a 2% – 3% coupon if the expectation for inflation is around 3% or more and the risk-free interest rate is similar? Therefore the price of a bond will fall until a large enough risk premium has been achieved compared to the risk-free interest rate.

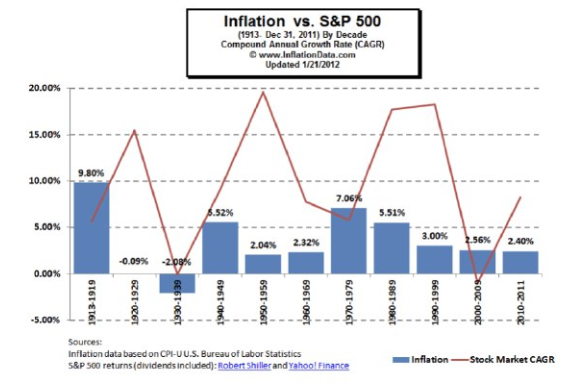

Let’s look at the statistics:

Traditionally, the US stock market moves ahead of inflation. If you look at the statistics of the US stock market from 1913 till 2017 (diagram of Inflation vs. S&P 500), you can see that the dynamics of the stock market has significantly outpaced the rate of inflation during almost all decades.

But, you can also see periods during which the stock market was unable to outpace the rate of inflation. Last time this happened in 2000-2009. At the start of this period stocks were very expensive (the dot-com bubble), and the end of this period the global financial crisis happened. Inflation is just one of many factors affecting the stock prices.

Inflation expectations

The actions of 5 major Central Banks that flooded the market with the liquidity in 2020 caused a quite reasonable inflationary expectation among investors. The below diagram demonstrates it clearly.

Based on this information we can conclude the following: stocks, as a rule, protect us from inflation, as they can give a positive real return. However, stocks don’t have the highest correlation with inflation. Commodities and raw materials have a higher correlation than stocks and thus can offer a better protection from inflation.

In 2020 the commodity markets were cheaper as never before when compared to the stock markets. Despite the recent out performance of the commodity market (GSCI commodity index) vs the S&P 500 index this year (14.6% vs. 4.8%), commodities remain cheap in comparison to stocks and offer an interesting investment case.

Why do we believe in commodity markets?

- The weakening of the US dollar. The market is expecting a weaker dollar due to low interest rates and the fiscal “bazooka” that is used by the US government. A weak US dollar is a positive factor for commodities as it leads to demand growth, which in turn can have a positive impact on price growth.

- Inflation expectations are rising due to a significant amount of fiscal stimulus, too soft monetary policy and the expected recovery in economic activity due to the spread of vaccines. Commodities have the highest correlation with inflation compared to other asset types and are therefore a hedge against inflation in the future.

- Commodity supply growth is limited due to the lack of investments in this «unpopular» sector of the economy during the last 5-7 years. When demand increases more than supply prices should rise.

In summary

The above 3 market conditions have created favorable conditions for a bull market in commodities. That is why, in the 4th quarter of 2020, Shoreline recommended its clients to reduce the proportion of bonds in their portfolios and increase the position of shares. In particular, we increased stocks in the commodities sector and recommended the purchase of commodity ETFs (iShares North American Natural Resources ETF and SPDR S&P Global Natural Resources ETF) in anticipation of inflation. If you wish to talk with a specialist about your portfolio please get in touch!