Advantages and disadvantages of equity compared to debt.

What is equity?

To understand the advantages of equities over debt we first need to determine what equity is. The term’s meaning depends very much on the context and generally means ownership of an asset. For most people equity is another word for stocks or shares, which represent ownership in a company. As a shareholder you own part of the company and thus can influence decision making and share in the profits the company generates via dividend distributions. But,

Equity advantages and disadvantages

There are three main asset classes – Cash, Fixed Income and Equities. The last is considered the most volatile and displays large fluctuations over a short period of time. This is one of the reasons why equities are considered the least secure of the three. When a company gets into financial difficulties creditors and bond holders receive money first. Shareholders receive any left over capital, usually that means nothing.

A change in the expected sales or profit figures of a company impacts the value of equities much more than fixed income. The market continually ‘prices in’ event probabilities, hence a surprise tends to moves the market significantly. Future owners expect to pay less for a stock if the company’s performance outlook deteriorates. Therefore the price goes down.

On the other hand, good news about a company’s performance moves its share price up. This is because more people now want to buy that stock and share in that company’s success. When the owner sells the stock for more money than he originally paid the owner generates a profit. Whilst the owner is a shareholder he may receive dividends, these are distributions from the company’s profits. Dividends are an additional source of income for the owner.

One of the major advantages of equities over debt is that equities have unlimited upside potential. As the name suggests, fixed income provides a fixed income for the entire term of the bond and the fixed nominal value upon maturity. Inflation decreases the purchasing power of money over time. A bond issued 20 years ago for $1000 will pay back exactly $1000 at maturity. The same amount on paper, but not the same value in real life. Companies however can increase their prices and thus sustain their profit margins which will reflect in their stock price.

Equity Valuation Models

The intrinsic value of a stock?

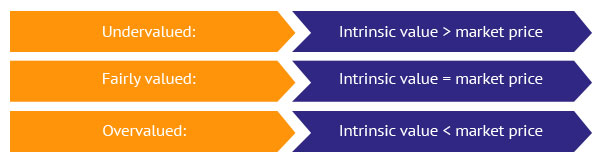

A stock is capable of holding intrinsic value, no matter its perceived market price. The intrinsic value is often an important aspect value investors consider when selecting companies for investment. During a market selloff, generally all companies suffer, regardless of their intrinsic value. However, once the market selloff is over companies whose market value is close to or below their intrinsic value can offer great opportunities. True value is always recognized and results in an attractive gain.

The below quote describes this theory accurately:

“The newer approach to security analysis attempts to value a common stock independently of its market price. If the value found is substantially above or below the current price, the analyst concludes that the issue should be bought or disposed of. This independent value has a variety of names, the most familiar of which is “intrinsic value””.

– Ben Graham, Security Analysis (1951 Edition)

One can also distinguish between direct valuation and relative valuation models. In contrast,

Relative Valuation Methods

Relative valuation methods do not provide a direct estimate of a company’s fundamental value. They only indicate how it compares relative to some benchmark or peer group. Relative valuation methods rely on the use of multiples. A multiple is a ratio between two financial variables.

Price Multiples

The most popular price multiples are earnings multiples. The price-to-earnings (P/E) ratio, which is equal to a company’s market price per share divided by its earnings per share (EPS), is the most widely used earnings multiple.

Direct valuation methods

Direct valuation methods provide a direct estimate of a company’s fundamental value, for example:

Discounted Cash Flow Models

DCF models use on one of the most fundamental principles of corporate finance: The value of a company today is equal to the present value of its future cash flows, discounted by a rate that reflects the riskiness (and uncertainty) of those cash flows.

As illustrated above there are many ways to value equities. But, what is the right way? The applicable model depends on a company’s industry, its characteristics and the analyst’s preference and expertise.

Place of equity in a portfolio

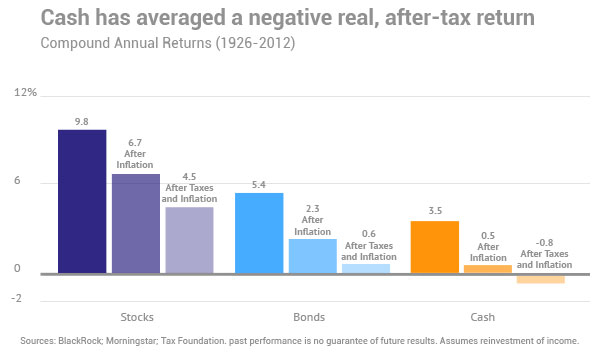

Now that we know more about equities, what place should equities take up in your portfolio? To answer this question let’s look at the historic performance of equities compared to fixed income and cash. The below chart illustrates this relationship clearly:

Over the long term, the advantages of equities over debt are clear as equities outperform bonds and cash, especially after the effect of taxes and inflation.

Currently interest rates and bond yields are even lower than in the chart. This makes the case to invest in equities only stronger. To achieve the best possible returns over the long-term a portfolio should, in theory, consist of 100% equities. By long term we mean any period from 5 years onward. The only time when fixed interest or cash-equivalent assets should form part of a portfolio is when the assets will be needed in the next two to five years. Until then there is no reason to hold anything but equities. Ignore short-term fluctuations when investing in equities, they are inevitable.